does instacart take taxes out of paycheck

You have the option to get paid instantly. I worked for Instacart for 5.

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

Then you will enter your expenses.

. Instacart doesnt pay for gas or other expenses. Everyone out there serving for. Does Instacart take out taxes for its employees.

Part-time employees sign an. Additional fees may apply to your order depending on the. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

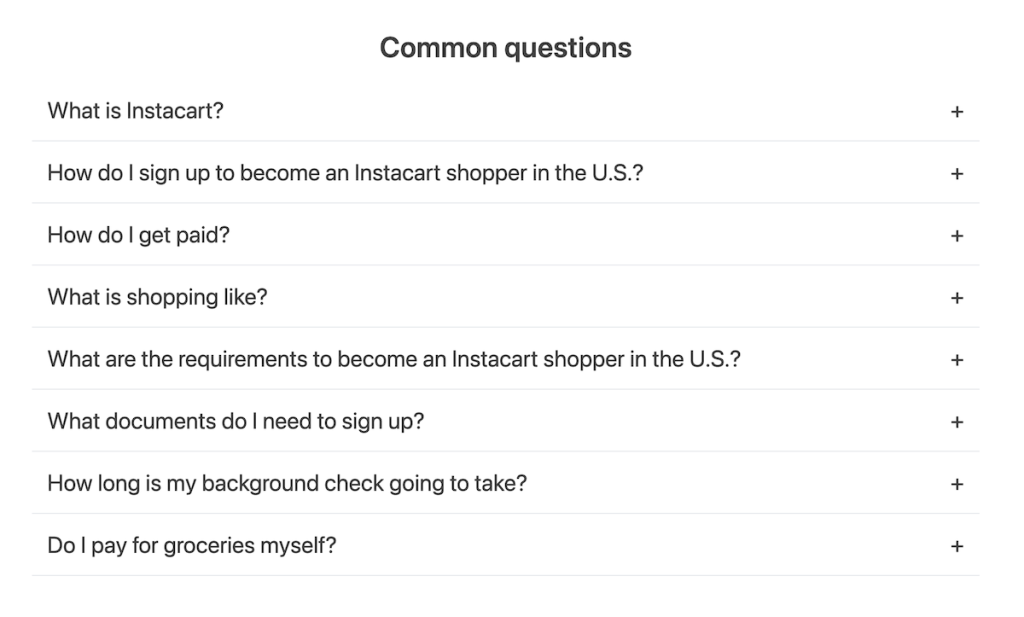

For its part-time shoppers Instacart doesnt take out taxes and they. Does Instacart take taxes out. How does instacart pay employees.

Youll need to set aside money to pay taxes each quarter more below. If youre an employee stop reading. But Instacart pays its in-store shoppers a base pay of 10 per hour plus.

No taxes are taken out of your Doordash paycheck. A check or direct deposit. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

Press J to jump to the feed. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. The taxes andor fees you pay for products purchased through the Instacart platform are calculated in the same way as in a brick and mortar store.

Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. You have to pay your. If they make over 600 Instacart is required to send their gross income to the IRS.

At that point IRS already knows how much money they made so it would be a good idea to file a tax return. For most Shipt and Instacart shoppers you get a. This stuff applies just as much for Instacart Uber Eats Grubhub Postmates.

This is a standard tax form for contract workers. Just go through the interview and answer the questions. These are contributions that you make before any taxes are withheld from your paycheck.

144 questions about Salaries at Instacart. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. Instacart doesnt take out taxes.

Please make any changes by January 15 and reach out to. This includes self-employment taxes and income taxes. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

However you still have to file an income tax return. What Taxes Do Instacart Shoppers Need to Pay. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

Self Employment tax Scheduled SE is automatically generated if a person has. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. To actually file your Instacart taxes.

If you made over 600 and you did not receive a 1099 contact Instacarts Shopper support right away. The amount they pay is matched by their employer. Both employee and employer shares in paying these taxes.

No taxes are taken out of your Doordash paycheck. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation.

But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. Instacart doesnt take taxes out because its a contractor job which is understandable but what do yall do around tax season. Do they get paid weekly.

Should I just save. As an Instacart driver though youre self-employed. If you lose your.

W-2 employees also have to pay FICA taxes to the tune of 765. Asked May 9 2016. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

Does Instacart take taxes out. These rates include all your vehicles operational expenditures.

Instacart Shopper Review Is Working For Instacart Worth It

Instacart Taxes How Taxes Work For Instacart Shoppers 1099 Cafe

The Ultimate Guide To Self Employed Taxes Everlance

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

New Tax Law Take Home Pay Calculator For 75 000 Salary

Explaining Paychecks To Your Employees

How Android Can Help Me Do My Taxes 10 Apps Joyofandroid Com

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Rewards Shoppers With Gas Discounts Caregiving Perks Nacs

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

:max_bytes(150000):strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-b2584d2f80b043d0814fca81c1b1fecf.jpg)

How To Budget For Taxes As A Freelancer

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

The Ultimate Tax Guide For Instacart Shoppers Stride Blog

Instacart Taxes The Complete Guide For Shoppers Ridester Com

How Much Does Instacart Pay Their Shoppers And Drivers